This ad ran in Roll Call today…

Tag Archive | "CFSA"

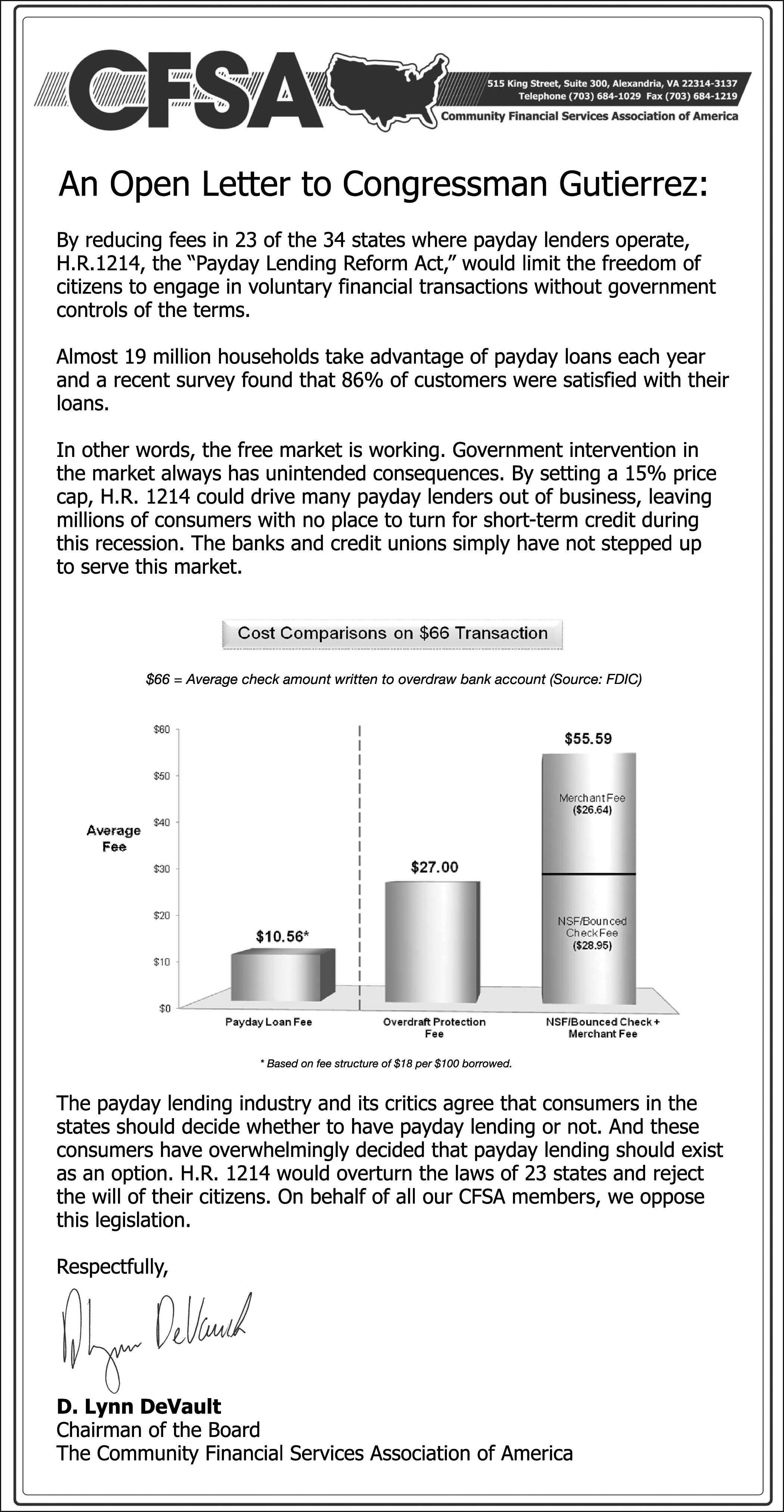

An Open Letter to Congressman Gutierrez

Posted on 29 April 2009.

Posted in federal legislationComments (1)

The payday lending customer

Posted on 18 February 2009.

New data about payday lending customers is on the CFSA website:

Middle-Income

- Majority earn between $25,000 and $50,000

Middle-Educated

- 94 percent have a high school diploma or better

- 56 percent have some college or degree

Posted in customers, industryComments (0)

Damned if you do, damned if you don’t

Posted on 04 August 2008.

The far Left publication Mother Jones has an article this week criticizing the payday lending industry for supporting the Congress on Racial Equility and spending money on Financial Literacy programs. Yes, you read that right. The industry is being criticized for charitable contributions. Kathleen Moore, who heads community outreach for CFSA, is quoted in the story:

Kathleen Moore, CFSA’s director of partnering and program development, who previously worked at Habitat for Humanity, insists that such outreach programs have nothing to do with politics or generating business for her members. “I do not promote payday lending. This is part of our giving-back agenda,” she says. “None of our outreach is targeted at ethnicity.”

Damned if you do, damned if you don’t. The Payday Pundit discussed the Mother Jones article in an earlier post.

Posted in industry, media coverage, Mother Jones, UncategorizedComments (0)

Urban Institute: Working families need access to small, short-term credit

Posted on 04 August 2008.

From the CFSA Press Release:

ACCESS TO SMALL, SHORT-TERM LOANS CRITICAL FOR WORKING FAMILIES

Urban Institute report recommends better disclosures and increased competition to protect consumers

WASHINGTON, DC–A new report by the Urban Institute finds that if payday advances are eliminated they “could be replaced by alternatives that make families even worse off.”

In “Enabling Families to Weather Emergencies and Develop the Role of Assets,” by Signe-Mary McKernan and Caroline Ratcliffe, the researchers find that low-income working families need access to small loans, such as payday advances, to help weather bad patches.

Instead of regulating prices charged on small, short-term loans, the authors argue that increasing competition will drive prices down. They express concern that regulating prices “would make fewer small, short-term loans available” and suggest that prices can be driven down, not by setting rates, but by “regulating disclosures; requiring licensing, reporting, and examinations; and creating incentives for financial institutions to provide small loan services.”

“The Urban Institute understands that eliminating payday advances is not in the best interest of working families,” said D. Lynn DeVault, president, Community Financial Services Association of America. “Its recommendations ensure that consumers would be aware of all of the fees associated with a credit product so they can compare their alternatives and make an educated decision based on what is best for them.”

Specific policy recommendations in the Urban Institute report:

- Disclosures. Regulate standard, clear, and timely disclosures of the total loan cost so consumers know their full obligation and can easily compare what various lenders charge for loans…Stating the fee as a dollar amount instead of or in addition to the annual percentage rate (APR) may be easier for consumers to understand on short-term loans.

- Longer-Term Products. Develop a longer-term loan product for habitual users—those who rely on short-term loans frequently or for long periods—is needed. Regulating disclosures and creating incentives for traditional financial institutions to provide small loans would create this product de facto.

Highlights available at http://www.cfsaa.com/FullDisclosures.html.

Posted in customers, industry, regulation, research, UncategorizedComments (1)

- Round of applause

- Let’s try not to make generalizations

- Quote of the day (from Tuesday’s Senate Banking Committee Hearing)

- Dear banks, make your disclosures more clear, Date says

- Cordray nomination passes Senate Banking Committee

- President Obama blasts BofA’s $5 debit card fee

- CFPB says ‘We’re listening’

- Update on Cordray

- And on that same topic, your Quote of the Day

- Do restrictions work, or are consumers going to unregulated entitites?

-

Payday Pundit: Thank you for asking! Please feel free to use our ...

-

Payday Pundit: Yes, we hope that it will be a fair and balanced p...

-

Jer Ayles-Ayler: We can only hope a journalist at Today will attemp...

-

Phil: I think check n go is thriving in this fierce comp...

-

Donya Jadlowiec: Hello could I use some of the material found in th...

-

Stay up to date

- Subscribe to the RSS feed

- Subscribe to the feed via email