The CFPB put up a blogpost today that has a Raj Date recap from yesterday’s meeting in Philadelphia. Click below to review the vid.

Miss Raj Date yesterday? See his full speech here

Posted on 16 September 2011.

Posted in CFPB, Financial Reform Bill - CFPB, Raj Date0 Comments

Continued quotes from Date

Posted on 16 September 2011.

Another quote from CFPB Interim Head Raj Date at yesterday’s event in Philadelphia, most notably the topic on short-term credit:

“We also recognize that there are a variety of products which are targeted at consumers who have a short-term need for cash – including products offered outside of the traditional banking sector,” Date said. “The consumer agency has the capacity to address this range of products in an even-handed way. ”

Date said that the agency plans to examine the issue to ensure the market for short-term credit is “fair, transparent and competitive.”

Posted in American Banker, CFPB, Raj Date0 Comments

‘Short-term lending helpful,’ says Advance America’s Fulmer

Posted on 16 September 2011.

Jamie Fulmer, spokesman for Advance America (a CFSA Member), had a letter to the editor published in the Jackson Clarion-Ledger yesterday, where he discusses the importance of short-term lending. As a response to a recently published article, Fulmer had this to say:

Your article described short-term loan customers as those “without access to other credit.” But when facing such a shortfall, consumers say they consider the pros and cons of credit cards, overdraft programs, and cash advances from banks, credit unions, and retail lenders.

They also weigh the costs and consequences associated with missing bill payments or submitting them late.

Consumers thrive in a competitive, regulated financial services environment. The Mississippi Legislature approved meaningful reforms last year, preserving access to a variety of regulated options and implementing consumer safeguards. That was step in the right direction. But we must continue to ensure that consumers are equipped with all of the information they need to compare services and make informed choices.

Posted in access to credit, CFSA, customers, industry, Jackson Clarion-Ledger, Mississippi0 Comments

What’s wrong with too much regulation? Uncertainty

Posted on 16 September 2011.

So what’s wrong with too much regulation? Uncertainty in the markets that will eventually trickle down to consumers, according to Warren Stephens. The CEO of Stephens Inc. was interviewed yesterday (you can watch it by viewing the video below) by FOX Business News regarding the impact of regs and rules out of Dodd-Frank and how they could impact access to credit. If you missed the Wall Street Journal story featuring Stephens, click here.

Posted in access to credit, customers, Financial Reform Bill - CFPB, Fox0 Comments

In other news…Warren has officially announced her Senate candidacy

Posted on 15 September 2011.

Former CFPB head front-runner and Harvard Law Professor Elizabeth Warren announced her campaign against Sen. Scott Brown (R-MA) earlier this week via a video blog. Check out the YouTube video below.

Posted in CFPB, Elizabeth Warren0 Comments

Overdraft protection getting eyed by CFPB

Posted on 15 September 2011.

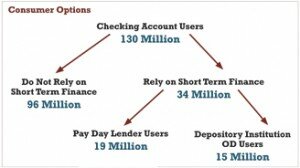

Raj Date says the CFPB is considering whether to impose rules on bank overdraft programs to ensure they’re being applied “in an even-handed way, according to Bloomberg. Date went on to say that U.S. regulators, including the Federal Reserve, have imposed rules on overdraft programs, and that may lead to inconsistent supervision of different kinds of financial institutions.

“We will be monitoring the impact of the recent regulatory and supervisory interventions,” he said during a Philadelphia speech today. “If we find that these interventions are not working as intended, we will adjust. And if we find that additional action is needed, we will act.”

Posted in Bloomberg, CFPB, customers, Financial Reform Bill - CFPB, Raj Date0 Comments

Thanks Moebs for confirming what we’ve been saying: Our service is cheaper

Posted on 12 September 2011.

First paragraph (and a few sentences) from a Credit Union Times article today, payday loans are cheaper for the consumer than overdraft protection:

If you’re going to overdraw your checking account by $100 or less, your most cost-effective bet is to borrow money from a payday lender, not to use an overdraft service or let your check bounce.

That’s the conclusion drawn from a recent study, “The Best & Worst Places for Overdrawing,” conducted by Lake Bluff, Ill.-based research firm Moebs Services.

“If a credit union truly wanted to serve its entire potential membership, why not act like a payday lender?” Moebs said. “Credit unions should go after the members who choose not to open a checking account because they’re afraid they will overdraw. If I were a credit union, I would get heavily into the overdraft business, go after the people with low FICO scores and lower my overdraft price.”

Posted in Uncategorized0 Comments

So how is this different from what we say?

Posted on 12 September 2011.

And again we ask, how is this different from what CFSA says? We have always promoted responsible use of the payday advance product, and even go as far to say in the Your Guide brochure handed out at our Member Company stores (both in English and Spanish): “Never use payday advances as a long-term solution for financial challenges.” Continued from the Las Vegas Review Journal story just posted:

“This is an expensive form of credit that is designed to be a short-term loan,” Messick said. “We don’t want them to use this to try and solve their long-term financial situation.”

Posted in access to credit, customers, Las Vegas Review Journal, Nevada0 Comments

Quote of the day

Posted on 12 September 2011.

Comes from a spokesperson from a CFSA Member Company, when commenting on banks entering into the payday loan arena, featured in this Las Vegas Review Journal article.

“There is a growing need for access to short-term credit,” said Jaime Fulmer, an Advance America spokesman. “Credit unions and banks offering short-term loans is a reflection of consumer demand.”

Truth is, though, that they’ve been offering direct deposit advances for quite some time (and Wells Fargo isn’t the only one).

“We have been offering these loans for a while,” said Richele Messick, a Wells Fargo spokeswoman. “To be eligible, you have to be an established Wells Fargo checking customer with recurring direct deposit or a tax refund.”

Posted in access to credit, customers, Las Vegas Review Journal, Nevada0 Comments

MO Ballot Initiative: Rife with unintended consequences

Posted on 07 September 2011.

Installment lenders in today’s Kansas City Star rightly point out that a proposed ballot initiative in the state amounts to an all-out assault on consumer credit that would impact banks, credit unions, and others. We seen this before — righteous, but misguided efforts to help borrowers actually drive them to more expensive and credit-damaging alternatives…

“Removing installment loans as an option for borrowers will force them to look to black market sources or unregulated Internet lenders for the money they need. This must not happen. If Missouri must deal with payday lenders, it must do so in a significantly more targeted way.”

Posted in access to credit, alternatives, industry, industry critics, Kansas City Star, Missouri, Rate Caps, regulation, State legislation0 Comments

- It’s true. Consumers will vote with their feet

- So what happens when you legislate legitimate lenders out of business?

- Round of applause

- Let’s try not to make generalizations

- Quote of the day (from Tuesday’s Senate Banking Committee Hearing)

- Dear banks, make your disclosures more clear, Date says

- Cordray nomination passes Senate Banking Committee

- President Obama blasts BofA’s $5 debit card fee

- CFPB says ‘We’re listening’

- Update on Cordray

-

Payday Pundit: We advocate for choices for consumers so that they...

-

Payday Pundit: A personal decision is really great way to think a...

-

Ava: I think the bottom line is that anytime you take o...

-

Burkey: Well, there's plenty of competition here in Los An...

-

Payday Pundit: Thank you for asking! Please feel free to use our ...

-

Stay up to date

- Subscribe to the RSS feed

- Subscribe to the feed via email