Posted on 12 September 2011.

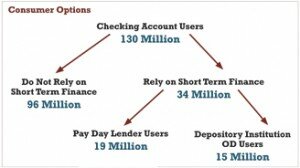

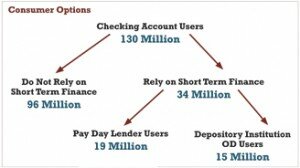

First paragraph (and a few sentences) from a Credit Union Times article today, payday loans are cheaper for the consumer than overdraft protection:

If you’re going to overdraw your checking account by $100 or less, your most cost-effective bet is to borrow money from a payday lender, not to use an overdraft service or let your check bounce.

That’s the conclusion drawn from a recent study, “The Best & Worst Places for Overdrawing,” conducted by Lake Bluff, Ill.-based research firm Moebs Services.

“If a credit union truly wanted to serve its entire potential membership, why not act like a payday lender?” Moebs said. “Credit unions should go after the members who choose not to open a checking account because they’re afraid they will overdraw. If I were a credit union, I would get heavily into the overdraft business, go after the people with low FICO scores and lower my overdraft price.”

Posted in Uncategorized

Posted on 31 August 2011.

Word and Way has a blogpost up that actually provides perspective on what could happen in Missouri if a prohibitive rate cap is put in place, albeit apologetic. The faith blog cited Kelly Edmiston’s, senior economist for the Federal Reserve Bank of Kansas City, study entitled “Could Restrictions on Payday Lending Hurt Consumers?” And the answer: Yes!

This research provides new empirical evidence on the potential benefits and costs to consumers of restricting payday lending. Edmiston says in his opening remarks:

“The analysis shows that restrictions could deny some consumers access to credit, limit their ability to maintain formal credit standing, or force them to seek more costly credit alternatives. Thus, any policy decisions to restrict payday lending should weigh these potential costs against the potential benefits.”

How, you say?

1. Lack of access to credit: “The most obvious and important cost of restricting payday lending would be the potential loss of credit access for consumers who may not have other sources of credit. Fully 50 percent of respondents to the 2007 payday loan customer survey responded that, when they secured their most recent payday loan, it was their only choice for short-term funds (Elliehausen). This assessment may have been inaccurate in some cases, but lack of knowledge about credit alternatives has the same effect as a true lack of access.”

Another important issue to keep in mind: “Without access to lenders, many financially constrained consumers may turn to family and friends. Payday lenders, however, report that many of their borrowers are reluctant to reveal their financial situation to others, or they have exhausted access to such loans (Caskey 2002). Others may not have family or friends with the financial means to help them.”

2. Credit standing. “When faced with unanticipated changes in income or expenses, a borrower may be forced to miss loan payments or even default on a loan. Unlike traditional lenders, however, payday lenders typically do not report to credit agencies. In the event that finances do not improve over the course of the loan period, defaulting on a payday loan would typically not harm the borrower’s formal credit standing. Thus, from this perspective, payday loans may be less risky than traditional loans.”

3. More costly alternatives. “While a payday loan under normal circumstances is costly to the borrower, its terms could be more favorable than those of other sources of credit. Clearly, if access to a traditional lender such as a bank is available, most would-be payday borrowers would be better off seeking short-term funds there. But few banks make small-dollar loans. Even if they did, few typical payday loan borrowers would have sufficient credit standing to acquire such a loan.”

Posted in access to credit, customers, industry, Missouri, Uncategorized

Posted on 13 June 2011.

According to a story from this morning’s Provo Daily Herald, the Coalition of Religious Communities has released a report claiming that a very high percentage of Provo’s district court’s small claims cases were filed by payday lending companies. Referring to the payday court traffic as a “significant drain on the system,” coalition member Linda Hilton singled out payday lending company Check City as the main cause behind the high numbers. Hilton claimed that the Provo based company requires its customers to report to court in Provo, no matter where their loan was purchased. We have yet to hear a statement from Check City, but will be following closely to see how reliable these claims truly are.

Posted in Uncategorized, Utah

Posted on 06 June 2011.

An editorial from today’s Star News (Wilimington, NC) cried foul about the recent small-dollar lending bill that passed the NC House of Representatives last week. In particular, the story accuses the lending industry of using its political contributions to gain influence over state lawmakers. What the editorial does not address, though, is the validity of the legislation itself. We hope that others will take a look at the actual impact of the bill, and not the politics surrounding it.

Posted in North Carolina, regulation, Uncategorized

Posted on 06 June 2011.

With a bill currently waiting for approval in California Senate that would raise the limits for payday loans from $300 to $500, Claudia Buck wrote an article in today’s Sacramento Bee profiling both the industry and the debate over the current legislation. One of the biggest proponents of the bill at hand is its author, Assemblyman Charles Calderon.

The bill’s author, Assemblyman Charles Calderon, D-Whittier, says California’s $300 limit is one of the lowest in the country and inadequate for today’s consumers. It doesn’t help those who need quick financial help, he says, whether “to pay your student fees or keep your phone on because you’re looking for a job.”

Posted in California, regulation, Uncategorized

Posted on 18 May 2011.

Not a tough call for some kids in middle school. Read about a unique financial literacy class.

Posted in Uncategorized

Posted on 17 May 2011.

From the story:

The number of requests for payday loans at the moneysupermarket.com web site has more than doubled in May, compared to April as consumers wrestle with rising food and petrol costs.

Payday loans are designed to be short term to allow the borrower to pay pressing and important bills such as rent or mortgages due before the next pay cheque arrives.

The amounts offered to consumers by payday loan companies usually range from £100 to £300, but this amount can go up to £1,000 in some cases. If an application is successful, money can be transferred into the borrowers account on the same day.

Posted in international, Uncategorized