Wisconsin’s Gordon Hintz to run for speaker?

August 25, 2009 | Wisconsin | Comments (0)According to a new column on BloggerNewsNetwork:

Democratic sources tell me that Hintz is using the payday loan issue to make a name for himself in the Legislature, and run for Assembly Speaker.

If Hintz truly wants to make a name for himself, he should do so in a manner becoming an elected official — one that doesn’t blatantly stink of ambition. If he wants to make an issue out of payday loans, he could do so just as easily by introducing common sense consumer protections. Why ban the product outright? In case he hasn’t heard, there’s a huge middle ground between banning something and having it unregulated.

Put the Leo Ryan Test to Gordon “Job Killer” Hintz

August 24, 2009 | Wisconsin | Comments (1)In his latest column, Lawrence Myers has much to say about Wisconsin assemblyman Gordon Hintz.

Before introducing his job killing, credit-restricting, consumer-harming, politcally-motivated bill to the Legislature, let him live the life of those who use payday loans.

Meanwhile in Wisconsin…

August 24, 2009 | Wisconsin, customers | Comments (0)Legislators are considering legislation that would eliminate payday lending in the state. The Northwestern spoke with one customer about the proposed legislation.

Althea Immonen, a nursing assistant who works in Oshkosh, recently paid off her loan at Check N Go, 2327 Jackson St. She opposes an interest cap at payday stores. She’s had a five-year relationship with Check N Go and she does not want it jeopardized.

Immonen said it’s hard to get a loan at a bank these days. Payday loans are fast and there is little “red tape,” she said.

“It works for people like us who have jobs and use it in a pinch. Things happen. That’s life,” Immonen said. “But this place is awesome. They work with me.”

Suddes column ignores the facts

August 24, 2009 | Cleveland Plain Dealer, Ohio, Thomas Suddes | Comments (2) In his latest rant against the payday lending industry in Ohio, Thomas Suddes argues payday lenders are operating through a loophole. The fact is, while dozens of lenders closed their doors upon passage of the annual rate cap in Ohio, other lenders, instead of laying off employees and turning customers away, began offering different credit products and services- all well within the Ohio lending laws.

In his latest rant against the payday lending industry in Ohio, Thomas Suddes argues payday lenders are operating through a loophole. The fact is, while dozens of lenders closed their doors upon passage of the annual rate cap in Ohio, other lenders, instead of laying off employees and turning customers away, began offering different credit products and services- all well within the Ohio lending laws.

In fact, during the legislative debate concerning payday lending, lenders were urged to apply for licenses to operate under Ohio’s Small Loan or Mortgage Loan Act and encouraged to come up with new credit products to service the growing consumer demand for short-term, small-dollar loans. This is exactly what lenders are doing- operating under the Small Loan or the Mortgage Loan Act, both which have been part of Ohio law for thirty years.

In sputtering economy, pawnshops are king

August 24, 2009 | alternatives | Comments (0)From Madison, WI’s Capitol Times,

Despite the proliferation in recent years of small-loan instruments — notably payday loans — the pawnbroker, with a history reaching back to the Roman Empire and ancient China, persists. And unlike payday loan stores, which have the feel of banking branches, a pawn shop’s eclectic mix of items and their owners offers a dramatic window into life during the economic downturn.

Seeking Alpha on financial oversite

August 21, 2009 | regulation | Comments (0)From Seeking Alpha blog, U.S. Economy: Now Comes the Hard Part

Are we going to be better off with the proposed Financial Services Oversight Council that would include the heads of the Treasury, Federal Reserve, Commodity Futures Trading Commission, Federal Deposit Insurance Corp., Securities and Exchange Commission and Federal Housing Finance Agency, and the directors of two new agencies the Obama administration wants to create: the Consumer Financial Protection Agency and the National Bank Supervisor? Are not these the same people asleep at the wheel during every angle of the financial excesses of the past decade? Aren’t these the same people who are bemoaning the lack of credit available to “average Americans and small business” and yet pass a credit card reform bill that began to reduce credit to average Americans and small businesses before the ink even dried?

Consumer Reports Q & A with Elizabeth Warren on the CFPA

August 21, 2009 | regulation | Comments (1)The Harvard Professor on why she thinks the creation of a Consumer Financial Protection Agency is a good idea. We agree with her on a few key points: consumer education and the need for transparency in financial products.

MO employers offering payday loans

August 21, 2009 | Missouri, alternatives | Comments (0)Today’s St. Louis Post Dispatch calls for an end to payday loans being offering to nursing home employees. The fact is, the employees who used this service likely did so to avoid late or bounced check fees. In almost all cases, the payday loans being offered cost less than the other options they were facing.

Marketwatch’s Chuck Jaffe bashes “Credit CARD Act”

August 20, 2009 | alternatives | Comments (0)

Latest column discusses how the unintended consequenses of the law will hurt consumers.

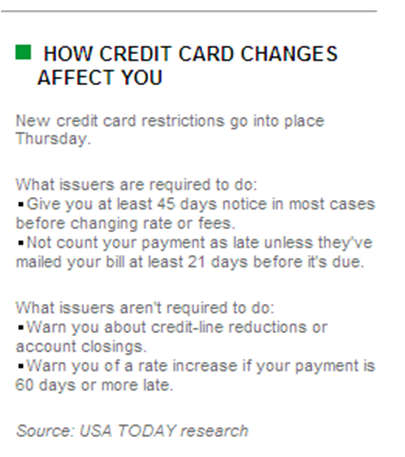

New credit card rules start today

August 20, 2009 | alternatives, industry | Comments (0)